|

| China Copper Resources |

The country's strategy focuses on expanding copper production and enhancing secondary material utilization.

China has announced plans to increase its domestic copper resources by 5-10% by 2027, along with a significant push to boost the use of secondary materials such as copper scrap. According to a February 11th statement from China’s Ministry of Industry and Information Technology (MIIT), the country will focus on expanding copper exploration and production in several key regions. These efforts align with China’s broader strategy to enhance its copper supply chain and reduce dependency on external sources.

Increased Domestic Copper Exploration and Smelting Projects

As part of its initiative, China will promote exploration in regions such as Tibet, Xinjiang, Yunnan, and Heilongjiang provinces. The country has already made substantial progress in discovering new copper resources, with over 20 million tonnes of new copper found in the Qinghai-Tibet Plateau since 2021. This is double the quantity discovered during the 2016-2020 period. To further boost copper production, China plans to develop new copper mines in these regions and integrate new smelting projects with concentrate production facilities. These projects are expected to play a key role in meeting the country’s growing demand for refined copper.

Boosting Copper Scrap Utilization

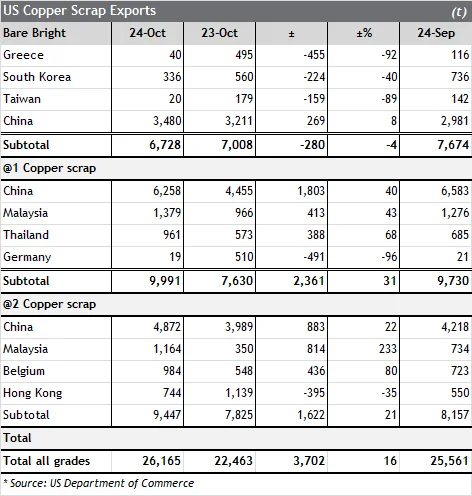

Another significant aspect of China’s strategy is increasing the use of copper scrap. Copper smelters will be encouraged to use more secondary copper, which has already become a major feedstock in the production of refined copper. In 2023, more than 31% of China's refined copper came from scrap, according to the China Nonferrous Metals Industry Association (CNMIA). To support this, the government plans to back the construction of new copper scrap recycling facilities and increase imports of copper scrap. In 2024, China’s copper scrap imports rose by 13%, reaching over 2.25 million tonnes, as smelters shifted to more cost-effective scrap rather than concentrates due to higher concentrate prices.

Global Copper Supply and Smelting Capacity

China’s increased demand for copper concentrate, along with the country’s focus on smelting capacity expansions, is expected to tighten global copper concentrate supply. This supply crunch has already led to a decline in treatment and refining charges (TC/RCs) since 2024. Market participants suggest that smelting capacity expansions may outpace new copper mine projects, contributing to continued global supply tightness in 2025.

Conclusion

China’s push to increase domestic copper resources and enhance the use of secondary materials, such as copper scrap, reflects a strategic move to secure its position in the global copper market. With growing demand for refined copper and a constrained global supply of copper concentrates, the country’s efforts to expand production capacity and increase recycling will be essential to meeting future copper needs.

We publish to analyze metals and the economy to ensure our progress and success in fierce competition.

We publish to analyze metals and the economy to ensure our progress and success in fierce competition.