|

| US Copper Scrap |

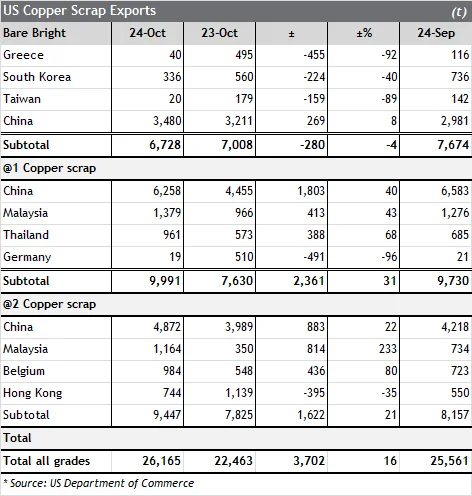

US copper scrap exports witnessed a remarkable 17% growth in October 2024 compared to the previous year, driven by increases in @1 and @2 copper shipments.

Strong Year-Over-Year Growth in Exports

The United States exported nearly 26,200 metric tonnes of copper scrap in October 2024, a significant rise from approximately 22,500 tonnes during the same period in 2023. This marks the 12th consecutive month of year-over-year increases, hitting the highest monthly total since May 2024.

However, the rise in total exports was contrasted by a 4% decline in bare bright copper scrap shipments, which fell to approximately 6,700 tonnes. Notable reductions in exports to Greece and South Korea contributed to this decline.

@1 and @2 Copper Scrap Lead Export Growth

Exports of @1 copper scrap surged by an impressive 31%, reaching nearly 10,000 tonnes. China was the primary driver, with an additional 1,800 tonnes compared to last year. While exports to Germany saw a decline, China’s demand more than compensated for the dip.

Similarly, @2 copper scrap exports climbed by 21%, surpassing 9,400 tonnes. The growth was fueled by heightened deliveries to major importing nations such as China, Malaysia, and Belgium.

Copper Prices and Market Trends

The October average for CME copper futures reached $4.42 per pound, marking an 81¢ increase from October 2023 and the highest monthly average since June 2024. Meanwhile, Asian @1 copper scrap discounts widened to 19.5¢/lb under CME prices, compared to 11¢/lb under in the previous year.

The elevated exchange prices, coupled with optimism for a stronger Chinese economy, drove higher consumer costs, averaging 73¢/lb above last year. The market responded to policy signals from China’s Ministry of Finance, including potential support for the real estate sector. These measures briefly boosted copper demand expectations, although the rally was short-lived. Market participants remain hopeful for further economic stimulus to drive China closer to its 5% growth target.

We publish to analyze metals and the economy to ensure our progress and success in fierce competition.

We publish to analyze metals and the economy to ensure our progress and success in fierce competition.

No comments

Post a Comment